Macro Overview November 2017

An improving economic environment and earnings optimism propelled markets higher, along with prospects that there might be some agreement on tax reform in Washington.

The House of Representatives released a draft of tax policy proposals known as The Tax Cuts & Jobs Act. The prospect of lower taxes for corporations and individuals are part of the proposals, while also targeting tax avoidance by multinational U.S. firms, reassuring markets that fiscal reform could prove possible.

Effects of hurricane influenced rebuilding efforts underway in Texas and Florida are expected to become more visible via labor and materials data over the next few weeks. Economists expect an increase in job placements and material costs as insurance claims start to pay out. Hurricane Harvey destroyed over 15,500 homes in Texas, while Hurricane Irma damaged 90% of the homes in the Florida Keys.

Apart from hopeful tax reform passage, equity markets have soared due to stronger global demand, improving earnings, and fewer regulatory hurdles. Internationally, global growth surpassed 4.5% in the second quarter, following a 3.9% increase in the first quarter. The data suggests that global production and consumption is increasing, eventually translating into higher earnings for global equities. The International Monetary Fund (IMF) issued increased growth estimates for 2017 & 2018 following better than expected growth data.

Repatriation of corporate cash is a top priority of tax reform where U.S. companies generating profits overseas are currently paying upwards of 35% tax. Large U.S. multinationals that have significant revenue generated outside of the U.S. stand to benefit the most from repatriation. Technology stocks alone hold over 60% of cash held overseas from profits. Should a reduced tax rate become effective on such large cash portions, companies could use the money to increase dividends, expand capital investment, hire employees, and make acquisitions.

The U.S. economy posted two consecutive quarters of GDP growth above 3% in the second and third quarter, marking the best six-month consistent period of growth in three years. Gross Domestic Product (GDP) grew at a 3.1% rate in the second quarter and 3% in the third quarter, per Commerce Department data. The subdued third quarter results are believed to be attributable to Hurricanes Harvey and Irma as economic activity came to a halt for portions of Texas and Florida. Economists believe that rebuilding efforts following the storms will give GDP growth a boost in the fourth quarter. Historically, U.S. GDP has averaged around 3% annual growth.

Proposed business tax reforms are expected to increase business investment, which has lagged in recent years. The Federal Reserve Bank of St. Louis released data showing that business investment rose 6.7% in the second quarter and 3.9% in the third quarter, a decline most likely caused by the hurricanes. Overall, a rising trend in business investment is a confirmation of improved confidence held by companies on economic and tax reform prospects.

Sources: House.gov, Commerce Department, Federal Reserve

Equity Update – Domestic Stock Markets

The Dow pierced through 24,000 towards the end of November as optimism about tax reform passage intensified. A primary emphasis to reduce both corporate tax rates and small business rates accelerated equity prices higher as optimism grew with the realization of passage.

The relationship between corporate taxes and equity valuations have been significant with the anticipation of a lower corporate rate, which has been elevating stocks ever since the election. The reduction in the corporate rate from 35% to 20% is expected to benefit certain companies more than others as tax rates vary among sectors.

Analysts view the recent decline in the technology sector as a form of market rotation, the exodus of assets from one market sector to another. The anticipation of various tax reform proposals may adversely affect technology companies while benefiting other industry sectors. The passage of tax reform might also prompt a further rotation to companies that may benefit from corporate tax proposals once in effect.

Sources: Dow Jones, S&P, Bloomberg

New Fed Chief On Track To Raise Rates – Monetary Policy

Jerome Powell, the new chief of the Federal Reserve, was confirmed by the Senate this past month, is scheduled to replace Janet Yellen who has been in the position since February 2014. Jerome Powell, 64, is a lawyer by training and an investment banker by trade with extensive exposure in the financial industry.

The Chair of the Board of Governors of the Federal Reserve System is also known as simply the “Fed Chair”. The Fed Chair is nominated by the President and serves for a four-year term, but may also be appointed for several additional terms. The President also appoints the seven members of the Board of Governors, which are confirmed by the Senate and serve four-year terms.

The selection and nominations for both Fed Chair and Board of Governor members can have political annotations, especially during periods of a new administration and economic change. Both equity and fixed income markets carefully follow the actions and policies set forth by the sitting Fed Chair, a determinant of the direction of economic expansion.

Sources: Federal Reserve

What A Flattening Yield Curve Means – Bond Market Update

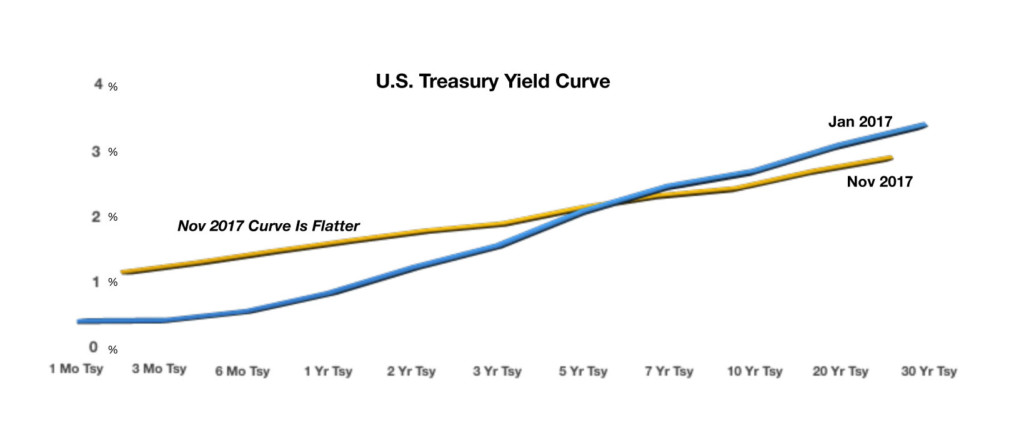

The anticipation of Fed rate hikes has gradually raised short-term rates this year, with the demand for longer-term bond maturities increasing. The result has been a flatter yield curve, where short-term rates have risen and long-term yields have dropped. A flattening yield curve implies that longer-term economic growth may be subdued or not expected to be very extensive. At the end of November, short-term rates such as the 2-year Treasury yield had risen to 1.75% from 1.22% at the beginning of the year. The longer-term 30-year Treasury bond yield fell to 2.77% on November 30th from 3.04% in January.

At the end of November, short-term rates such as the 2-year Treasury yield had risen to 1.75% from 1.22% at the beginning of the year. The longer-term 30-year Treasury bond yield fell to 2.77% on November 30th from 3.04% in January.

As promised, the Fed has started to curtail its buying of Mortgage Backed Securities (MBS). Through September, the Fed was buying an estimated 20-25% of the roughly $110 billion of MBS sold each month. In October, the Fed scaled back its purchases by $4 billion and is scheduled to reduce purchases by another $4 billion every quarter. As the Fed buys less and less MBS, the market will need to slowly absorb the additional paper made available by the Fed’s lack of buying. As this occurs, it is expected that MBS prices will gradually fall and yields will gradually rise.

Sources: Federal Reserve, Bloomberg, Treasury Department

Household Debt On The Rise – Consumer Behavior

As the economy has grown, so has household debt. Data tracked by the Federal Reserve shows that debt held by U.S. households rose to over $12.9 trillion in the third quarter, the highest level ever. A favorite form of consumer debt, credit cards, rose by 3.1% for the quarter. The Fed report did note that delinquencies among credit cards and auto loans were rising, an indication that some households might be overstretched.

According to data from the Federal Reserve Bank of New York, total household debt climbed to $12.96 trillion at the end of the third quarter. The current amounts now surpass the debt levels Americans had in 2008, when total consumer debt reached a record high of $12.68 trillion.

The Fed tracks household debt by categories, such as mortgage, student, credit cards, home equity loans, and auto loans. Over the decades, the most consistent and significant amount of household debt has been mortgages.

The recent increase in total overall debt is primarily attributable to a steady rise in both student and auto loans. Recent Federal Reserve data shows that these two loan types are primarily held by younger consumers. The concern is that the difficulty of obtaining mortgage loans has led younger consumers to take out student and auto loans instead.

An upturn in delinquent credit card debt is a concern to the Fed, since it has occurred during a period of job market strength. The culprit might be that workers may not be earning more, but just working more.

Sources: Federal Reserve Bank of New York

Bitcoin Hysteria – Digital Currency Overview

Euphoria has sweep Bitcoin to unreal levels over the past few weeks. Bitcoin, one of many digital currencies, shot past 11,000 in the final week of November after eclipsing 10,000 just hours prior. The cumulative value of all cryptocurrencies throughout the world are estimated to be more than $300 billion, an enormous increase from the $18 billion at the beginning of the year.

The commodity futures trading commission granted the Chicago Board Options Exchange (CBOE) to issue Bitcoin futures which will allow traders to bet on the price of the digital currency via a trusted exchange. Traders will be allowed to bet on the appreciation of the cryptocurrency or the demise of it by buying and selling the futures.

What took the equity markets decades to establish, the cryptocurrencies market is trying to build in mere months. Bitcoins emerged in 2008 designed by a programmer or group of programmers under the name of Nakamoto, whose real identity remains unknown. New Bitcoins can only be created by solving complex math problems embedded in the currency keeping total growth limited.

Many believe that the development of digital currency it is just beginning of a globally accepted process sometime available in the near future. Bitcoin could merely be a stepping stone to an eventual acceptance of digital currency. Bitcoin currently accounts for roughly 55% the total digital currency market, down from 87% of the total market at the beginning of year. Hence, Bitcoin has incredibly fast growing competition. Bitcoin is currently one of over 1000 other digital currencies in the marketplace. Other popular cryptocurrencies include Ethereum, Ripple, Litecoin, NEM, Dash, and IOTA, to name just a few.

Digital currencies are being examined as a store of value and a method of making monetary payments. Gold, an accepted store of value, and currencies issued by countries have been established internationally for centuries and are and now challenged by the cyptocurrency concept.

Digital currencies are being examined as a store of value and a method of making monetary payments. Gold, an accepted store of value, and currencies issued by countries have been established internationally for centuries and are and now challenged by the cyptocurrency concept.

One factor driving Bitcoin's growth has been the emergence of a broader cryptocurrency ecosystem. Bitcoin serves as the reserve currency for the cryptocurrency economy in much the same way that the dollar serves as the main anchor currency for international trade. Bitcoin has been recognized as the first truly decentralized electronic payment network.

A looming regulatory crackdown is affecting the digital currency as well. Bitcoin has already been hit by a crackdown from Chinese officials who have been severely restricting the use of cryptocurrencies. In the United States, there's little risk of a direct crackdown on Bitcoin, but there's a real risk that the Securities and Exchange Commission will crack down on the ICOs (Initial Coin Offerings) that have pushed Bitcoin's price upward. An unregulated means by which funds are raised for new crypto currency bench ICOs are used by startups to bypass the rigorous and highly regulated capital raising environment.

Bitcoins exist as software, not physical currency, and are not regulated by any country or banking authority. Even though U.S. Senate hearings disclosed that Bitcoin could be a means of exchange, it gave no assurance that it would actually become an accepted medium of exchange. Government regulations would need to be created and then enforced in order for Bitcoin to become accepted by other government entities. The currency can be traded without being tracked, thus raising the potential for illicit activity, such as involving weapons, drugs, and prostitution. Even though Bitcoins are not illegal, it is not legally recognized by governments as a currency.

Some believe that the price appreciation of Bitcoin has been solely a result of speculation and hasn’t yet been used as a store of value or as a medium of exchange to any extent. Some compare Bitcoin to the tulip craze in Holland of 1637, when speculators pushed the price of tulip bulbs to incredible levels, followed then by a collapse in the tulip bulb market. Bitcoin has also surged on speculation that perhaps one day digital money will eventually become a legitimate global currency and even replacing currencies from certain countries.

Bitcoins are mined by powerful computers that calculate complex, mathematical functions. Total Bitcoin quantity is capped at 21 million and currently there are about 12.4 million that exist worldwide.

The growing mobile payment industry could be a big benefactor to the acceptance of Bitcoin as new and creative applications are being devised to accept digital currency. Bitcoin transactions are very popular among mobile users, where rather than using a credit card or cash to make a purchase, all you need is your phone.

In 2014, the value of Bitcoins fell by over fifty percent following remarks by China and Norway to not recognize the digital currency as legal tender. The government of Norway ruled that Bitcoin does not qualify as real currency but rather qualifies as an asset, producing taxable capital gains. Norway said that Bitcoins don’t fall under the normal definition of money or currency.

More and more nations have been taking an official stance as the popularity of Bitcoins has evolved. The European Banking Authority has warned about the risks of trading digital money and subject to losses where consumers are not protected by any government entity or authority.

As digital currency evolves, some believe that it will eventually be accepted as a legitimate currency. But for the time being, others believe that its time hasn’t arrived yet. Various studies have recently emerged with different opinions, such as a Stern School of Business study conducted by David Yermack, which concluded that Bitcoin behaves more like a speculative investment than a currency and has no currency attributes at all.

Sources: Bloomberg, Reuters, cointelegraph.com

The Tax Cut and Jobs Act – Fiscal Policy Update

Senate and House Republicans each passed their own version of the Tax Cuts and Jobs Act, yet differ in various ways, setting arguments into motion. When the chambers pass different versions of a bill, conferees are appointed by both the House and the Senate to produce a “conference report” that is satisfactory to the majority of conferees from each chamber. The closer the two sides are going into conference, the easier the resulting process.

The focus of the Tax Cuts and Jobs Act is to lower taxes mainly for corporations and smaller businesses, and a portion of individual taxpayers. Targeted are wealthy individuals who live in high tax states that may lose valuable deductions. So the emphasis of tax reform this time around is on reducing corporate taxes, paid for by higher taxes on wealthier individuals due to a sustained top tax rate and loss of various deductions.

Where both the House and the Senate agree:

-Applying Chained CPI;

-Retain the state and local tax property tax deduction, capped at $10,000;

-Expand 529 college savings accounts to apply to some primary and secondary education;

-20 percent corporate rate, reduced from 35%;

Applying the Chained CPI to benefit payments, such as Social Security, is a means of reducing the U.S. federal budget deficit by reducing the rate at which government benefits grow. The government currently uses the standard CPI to calculate COLA increases for Social Security payments. The Chained CPI essentially assumes that consumers will choose less expensive substitutes to purchase during rising inflation. Less expensive goods will pull down inflationary calculations possibly leading to smaller COLA increases.

Some states and municipalities that issue tax-free bonds will be affected. Bonds issued by municipalities to build certain complexes such as a sports stadium, would no longer qualify for tax exempt status, leaving it to private investors and owners to figure out financing.

Before the President can formally endorse the passage of the tax reform proposals, both the House and Senate will have to agree on one plan. The objective is to have the House and Senate hash out the details of both plans into a single piece of legislation and have it ready for signature by the President by the end of the year.

Sources: Tax Foundation, IRS, Congress.gov/bill/115th-congress/house-bill/1

The Internet Is Being Deregulated – Government Regulations

The primary growth behind the internet isn’t the number of websites, but the growth of traffic within the invisible freeways it commands.

The evolution of technology has enabled nearly every American to have access to the internet, but at a price. As the number of users grew so did the volume of traffic, which like a highway, eventually needs speed limits. These speed limits were imposed during the prior administration with the intent of making the internet equally accessible to all users. Many have complained that the utility-like regulations have hindered competition and limited the entrance of new technology.

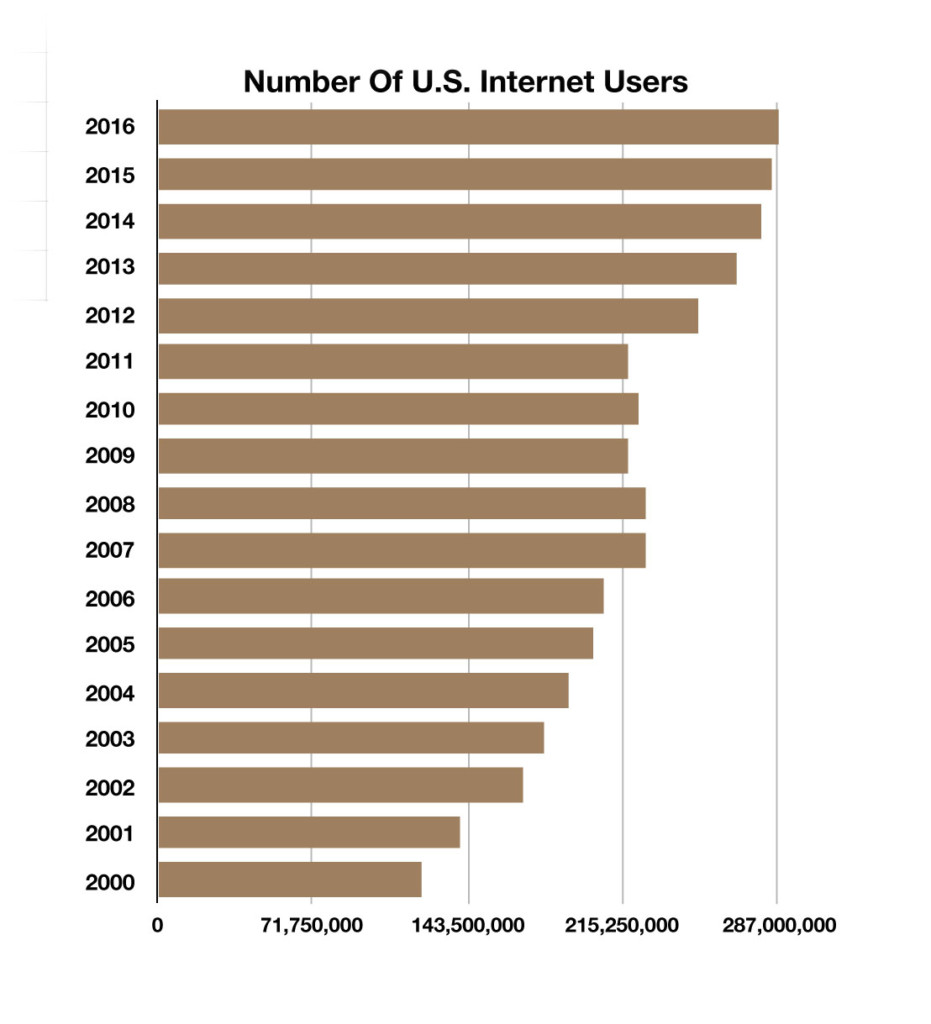

Data compiled by Internet Live Stats estimates that there are over 3.7 billion internet users worldwide, with nearly 287 million in the United States. As a percentage of population, the U.S. ranks 40th in internet users internationally, with roughly 88% of Americans having internet access. Scandinavian countries have among the highest percentages of users, with Denmark at 96.9% and Iceland at 100%. Many have argued that unnecessary regulations and minimal competition have limited additional users in the U.S.

The Federal Communications Commission (FCC) voted in November to repeal 1930s era utility style regulation called Title II which has put at risk online investment and innovation since it was enacted in 2015 by the prior administration. The FCC plans to encourage a free and open internet by promoting broadband deployment in rural American towns and new infrastructure investments throughout the nation.

The FCC outlines that it will honor and expand on the four “Internet Freedoms” implemented in 2004; freedom to access lawful content, freedom to use applications, freedom to attach personal devices to the network, and freedom to obtain service plan information.

Sources: Internet Live Stats, Federal Communications Commission

*Market Returns: All data is indicative of total return which includes capital gain/loss and reinvested dividends for noted period. Index data sources; MSCI, DJ-UBSCI, WTI, IDC, S&P. The information provided is believed to be reliable, but its accuracy or completeness is not warranted. This material is not intended as an offer or solicitation for the purchase or sale of any stock, bond, mutual fund, or any other financial instrument. The views and strategies discussed herein may not be appropriate and/or suitable for all investors. This material is meant solely for informational purposes, and is not intended to suffice as any type of accounting, legal, tax, or estate planning advice. Any and all forecasts mentioned are for illustrative purposes only and should not be interpreted as investment recommendations.